COVID-19 has impacted companies across the globe causing demand and supply side shocks and resulting in significant liquidity risk.

Making matters worse, foreign exchange volatility is amplifying cashflow uncertainty, putting even greater stress on liquidity and risk metrics.

In the best of times, market volatility can have a major impact on cashflow and earnings. Amid the COVID-19 pandemic, tracking the effects of market volatility is vital. CFOs and company boards are looking to their treasury departments for accurate cash forecasts to provide a level of certainty about corporate liquidity. Unhedged FX exposures will have a direct effect on forecasting accuracy, resulting in an incomplete liquidity picture and multiplying the pressure on working capital.

Faced with adverse FX movements, companies must have robust analytical tools and well-defined market risk policies in place to analyze the effects of FX volatility and make more informed risk management decisions. Understanding the potential stress on cashflows and earnings will put you in a better position to revise existing hedging strategies to minimize the almost certain market risk.

Identify exposures

It is fundamental to FX risk management that exposures are clearly identified and analyzed to establish how significantly each exposure contributes to overall enterprise risk. Accurately forecasting existing exposures is essential as it will become the baseline for modeling all subsequent risk management activities. Forecasting must be based on a reasonable time horizon; not too short that the risk is understated and not too long that uncertainty impacts forecasting accuracy. Both external and intercompany exposures should be surfaced to give a complete picture. Forecasts should incorporate any natural hedging or seasonality that may occur in the business cycle. In companies with numerous market risk factors, it is also important to identify any possible inter-relationships or correlations between the different risk factors (e.g. FX and community risk).

GTreasury is here to help.

A treasury management system can streamline many of the labor-intensive tasks outlined in these recommendations.

There are three main methodologies that are regularly applied to quantify financial risk:

Methodology and Risk Measurement

With baseline forecasts complete, you need to establish an appropriate methodology for the measurement of FX risk.

Market risk can be measured using either an earnings/cashflow or an economic-value approach. For example, in the case of a foreign exchange book the best methodology would be a cashflow approach since a shift in a currency pair will cause an upward /downwards effect on earnings. On the other hand, an investment portfolio of fixed income securities would be best suited to an economic-value approach since the present value of the portfolio would decline with an increase in the interest rates.

- Scenario Modeling (Deterministic modeling)

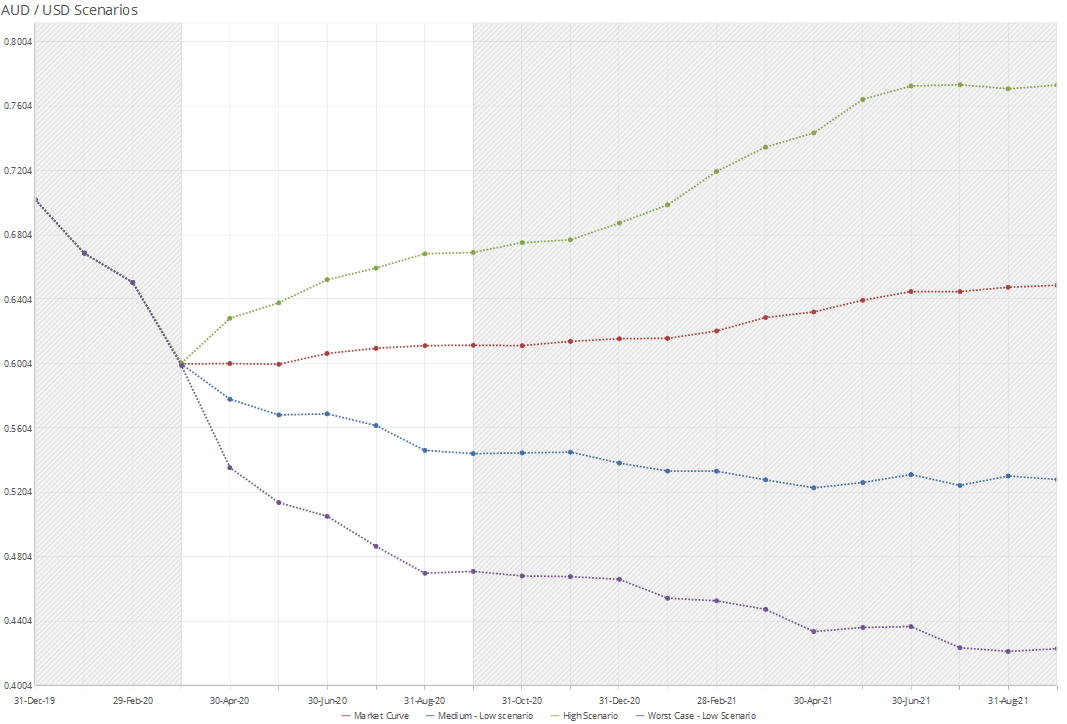

This is the simplest approach to stress testing and attempts to project a range of ‘likely’, ‘worst case’ and ‘best case’ forward-looking cashflow scenarios. With this type of analysis, we are not trying to predict where the FX rates will go. Instead, the goal is to provide clear visual and analytical representation of the company’s risk exposure across different hypothetical FX rate scenarios and quantify the potential impact on cashflow. The risk can then be reported as a variance between the ‘likely’ and ‘worst-case’ outcomes or between the ‘best-case’ and ‘worst-case’ outcomes. While treasurers are always looking to minimize downside risks, it is important to incorporate a best-case scenario used to highlight the ‘opportunity cost’ that might result from any measures to minimize the negative impacts.

In practice, a forward market curve is typically used as the ‘likely outcome’ scenario. High and low scenarios can either be modeled as a parallel shock to the market curve, or more realistic shifts and twists can be used to model changes under specified circumstances.

- Cashflow-at-Risk (Stochastic Modeling)

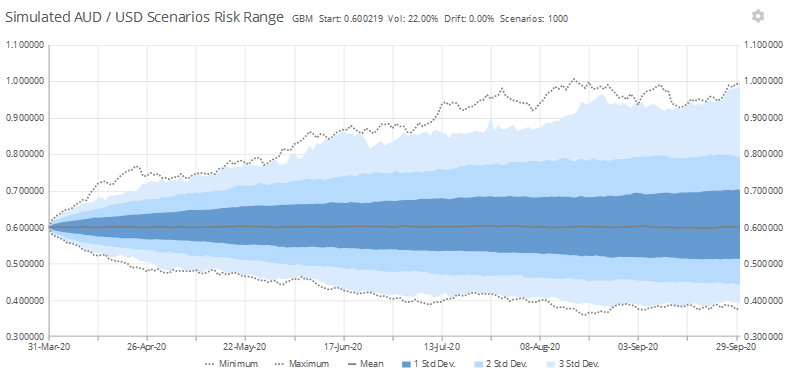

A Cashflow-at-Risk (CFaR) simulation is a sophisticated modeling method that applies Monte Carlo simulations to generate large numbers of future FX rate paths and applies them to the forecast exposures, serving to eliminate the guesswork inherent in scenario forecasting. Where a spreadsheet model will only calculate a single scenario outcome, a simulation like a CFaR randomly calculates large numbers of scenario outcomes. As an example, GTreasury can generate up to 32,000 scenarios with either fixed or random seed values.

CFaR is a highly effective mechanism for testing the effectiveness of your risk management strategy and helps you to gain a richer understanding of the risks associated with your exposures. The simulation approach generates a broad range of possible cashflow outcomes and then calculates the statistical probability of such outcomes occurring. It is trying to statistically answer the question: “To a specified level of confidence, how bad could my cashflow get over a certain time period?”

Various algorithms can be used to generate the simulations, and the choice of simulation, i.e. Brownian Motion, Geometric Brownian Modified, Mean Reversion, will fit your particular risk factor better than others. Certain parameters that will impact the outcomes must be entered by the risk manager to feed the model, i.e. volatility, long-term mean or others.

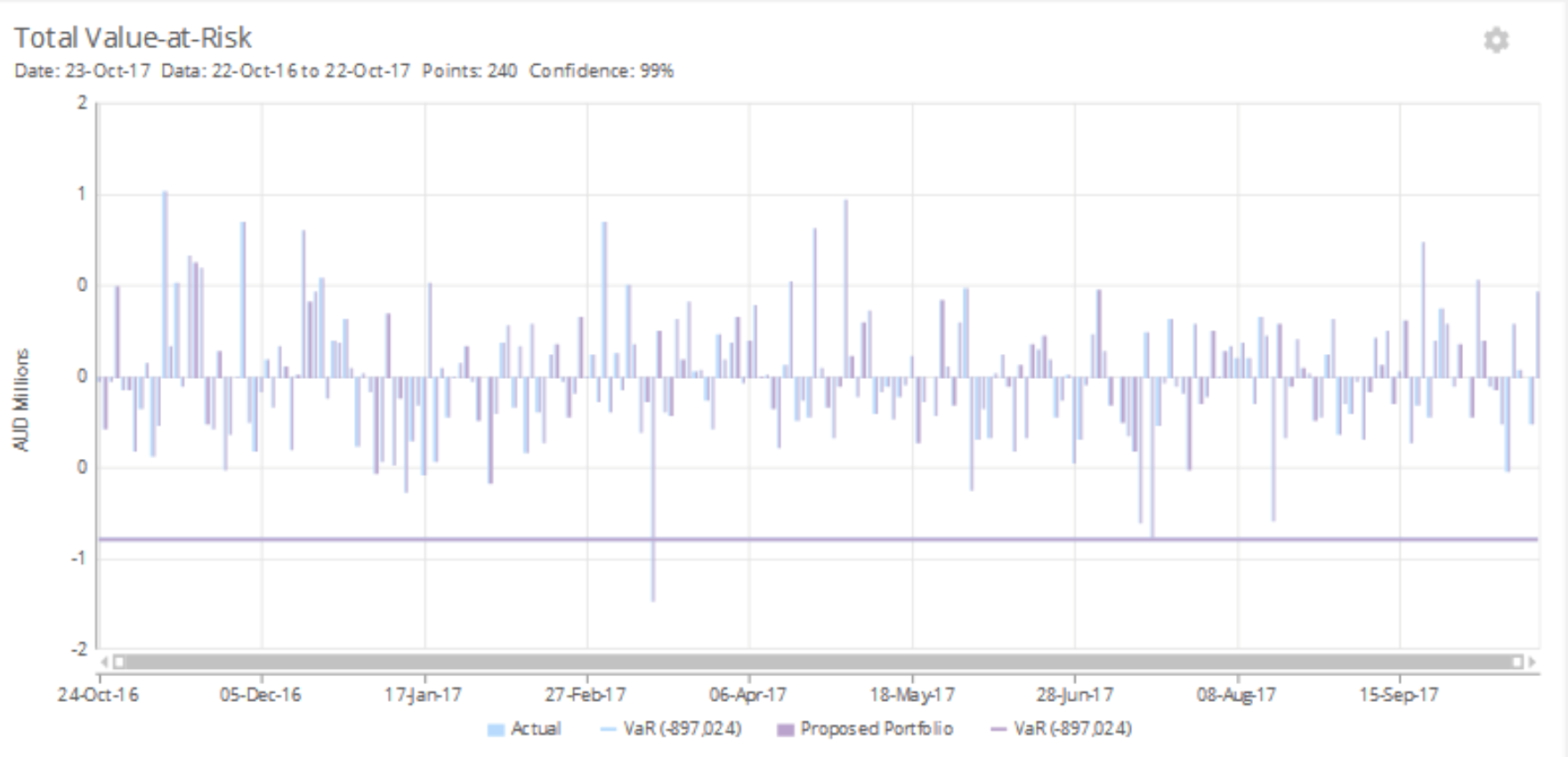

- Value-at-Risk (VaR)

VaR applies either historical rates or simulated price curves to study the possible impact on market values rather than future cashflow. In this case, a VaR analysis is trying to statistically answer the question: “Within a specified level of confidence, what is the maximum my investments could lose due to FX volatility over a specified time period?” Statistical analyses are then carried out to assess a range of valuation sensitivities.

Scenario modeling and CFaR are most appropriate for analyzing cashflow while VaR is more appropriate for analyzing market stress on investments. All these metrics can be used either in isolation or in conjunction to provide differing views of the risk profile. For example, a CFaR model can used to generate an expected worst-case outcome, and scenarios can be used to further stress-test that expected outcome.

Practical Considerations

Having selected a model and consolidated your forecasts, you will, of course, incorporate any existing hedging contracts into your modeling activities. Your work should take account of contingent cashflows, for example a scenario or simulation generating a market price path that results in an option being struck.

When deploying your analytic models, you will want to take account of various inputs and parameters including the following:

| Deterministic Scenarios | Stochastic Simulations (CFaR) | |

|---|---|---|

| Hedge Ratios | Y | Y |

| Reporting Buckets | Y | Y |

| Scenario Start Rates | Y | Y |

| Target / Budget Rates | Y | Y |

| Algorithm Type | Y | |

| Long-Term Mean | Y | |

| Mean Reversion Term | Y | |

| Annual Volatility | Y | |

| No. / Size of shocks p.a. | Y |

The inputs to your models can be used to consider periods of previous stress that you wish to protect against. For example, you might enter annual volatility and average shock sizes observed during the 2008 crisis to understand the impact of similar shocks on your current exposure profile. Treasurers will also look to compare before and after cashflow metrics for your current book and proposed hedging strategies.

Conclusion

With COVID-19 dominating headlines and driving unprecedented volatility globally, the market has seen commodity currencies such as AUD and NZD facing downward pressure, whereas safe haven currencies such as USD, JPY and CHF have strengthened. Oil prices are facing historic lows and have further affected CAD and NOK, in particular.

When revenue streams are uncertain, a review of risk management policies is clearly in order. FX shocks and funding stresses need to be reviewed to decide whether your risk tolerance is reasonable in the current climate. Appropriate stress testing will provide a broader perspective into your underlying risk exposure, enabling you to institute better-informed hedging policies.